Global rice prices, which have plunged to multi-year lows, appear to have found a floor—but any hopes of a rebound are likely to be crushed under the weight of India's massive stockpiles and a surplus in major exporting nations, according to industry experts.

📉 Prices Stabilize After Steep Fall

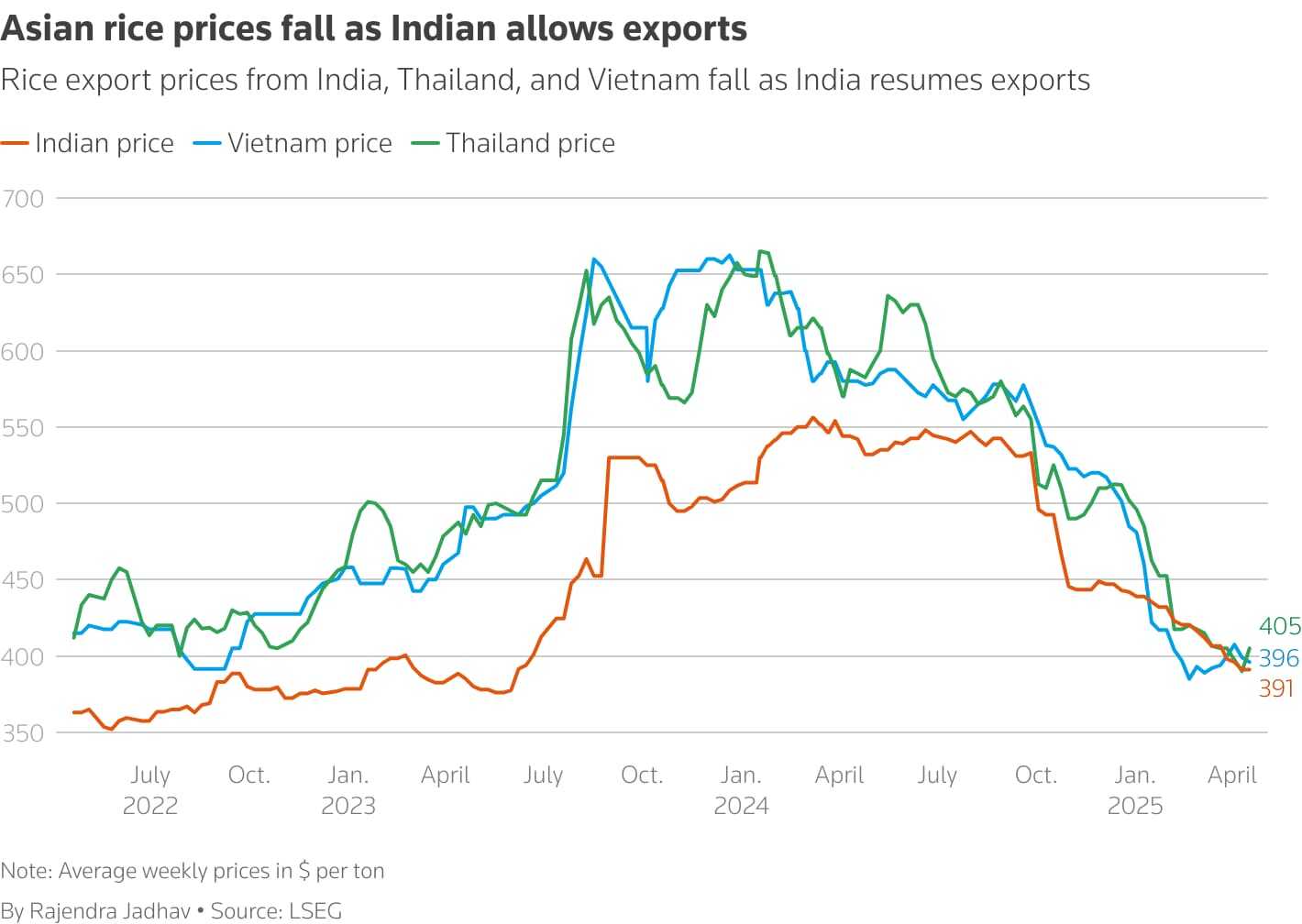

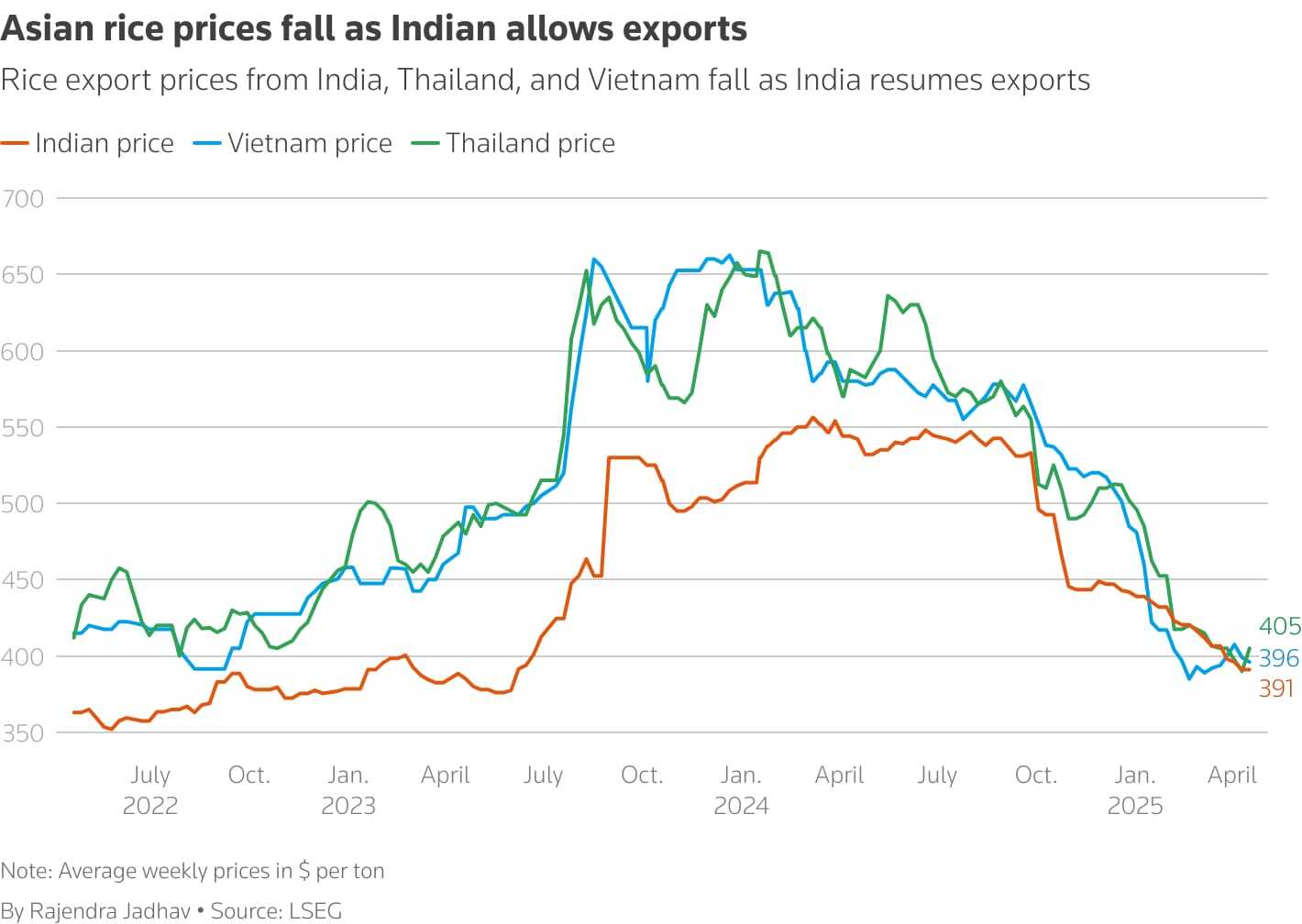

After a sharp decline of nearly one-third from their 2024 peaks, rice prices have steadied in recent weeks. India’s parboiled rice export prices sank to a 22-month low, while benchmark prices in Thailand and Vietnam plummeted to levels not seen in three and five years, respectively.

The slump was triggered by India’s move in March to remove its last remaining export restrictions imposed in 2022, flooding the global market with competitively priced grain and intensifying price competition.

🌾 India’s Dominance Deepens

India, the world’s largest rice exporter, is poised to set a new record with exports projected to jump 25% this year. As the rupee strengthens and domestic stockpiles swell, Indian rice is undercutting rivals on the global stage.

“Even after the recent significant correction, we don't expect a price rebound. The supply glut will likely prevent prices from increasing,” said B.V. Krishna Rao, president of the Rice Exporters Association of India. He expects 5% broken rice prices to hover around $390 per ton, fluctuating within a narrow $10 range through the rest of 2025.

“Prices will remain around the current level unless the monsoon pulls a surprise and affects production,” added Himanshu Agrawal, executive director of Satyam Balajee, a major rice exporting firm.

🌍 Global Surplus Pressures Market

According to the UN Food and Agriculture Organization (FAO), global rice supply including carryover stocks is projected to exceed demand by 27% this year, adding to the bearish sentiment.

While this glut will provide relief to price-sensitive consumers in Africa and other regions, it threatens to further depress farm incomes across Asia, home to 90% of global rice production. Many smallholder farmers are already struggling with rising input costs and climate uncertainty.

🇹🇭 🇻🇳 Thailand, Vietnam Face Export Declines

In contrast to India’s expanding market share, Thailand and Vietnam are forecast to experience sharp drops in their rice exports in 2025, partly due to stronger local currencies and tighter supplies. The competitiveness of Indian rice has made it difficult for other exporters to match its prices without sacrificing margins.

📊 Outlook for 2025

While prices are unlikely to dip further, meaningful recovery appears out of reach unless major weather disruptions occur—particularly in the Indian subcontinent during the critical monsoon season. For now, the global rice market is set to remain in a state of oversupply, with India cementing its dominance while traditional exporters scale back amid tighter margins and lower demand.

Follow & Subscribe:

👉 Agri-Food Update on LinkedIn for the latest updates and insights.

🌐 Visit us at www.agri-food-update.com for more information!