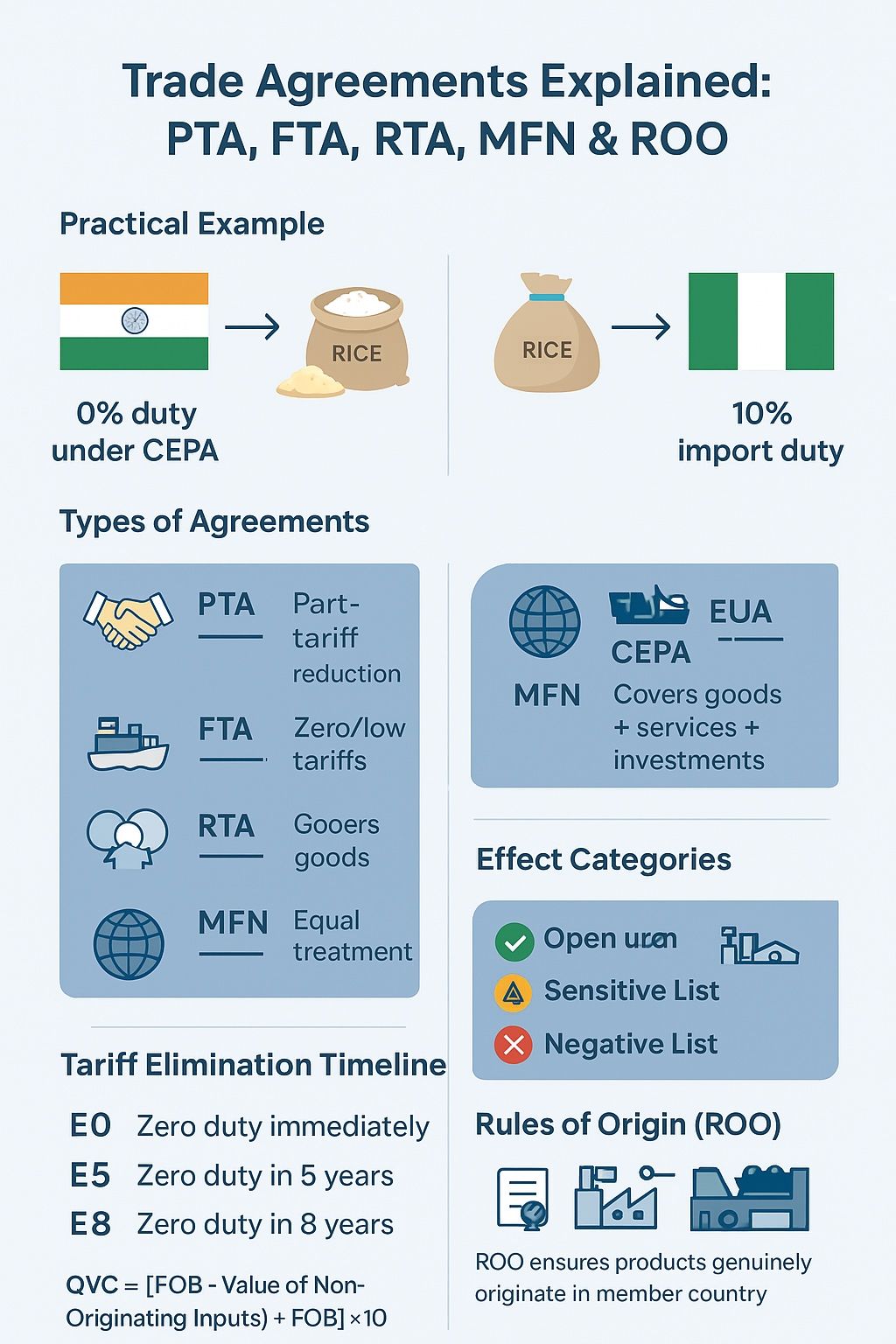

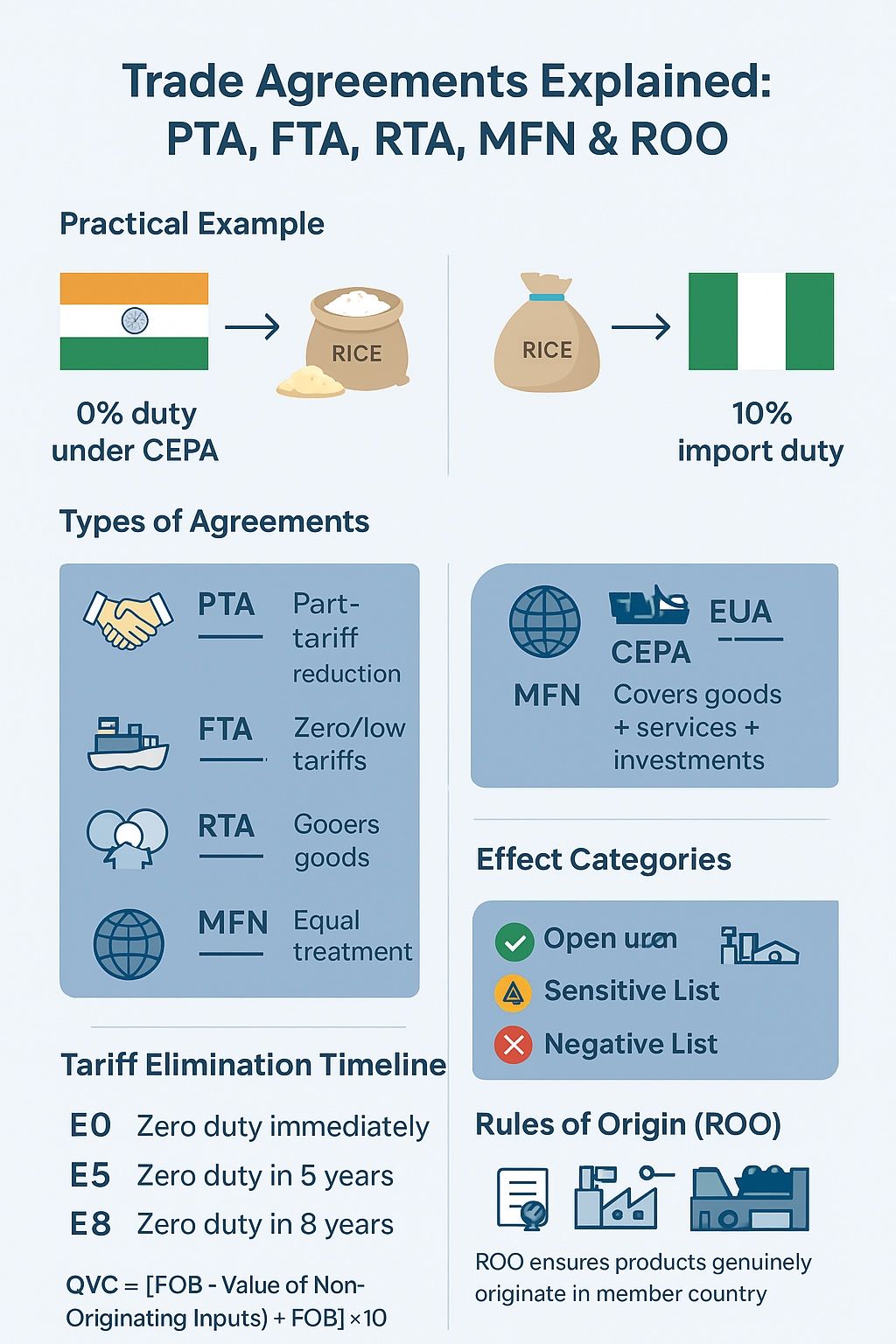

Consider this: India exports Basmati rice to two countries — UAE and Nigeria.

• To UAE: Under the India–UAE CEPA (FTA), import tariffs on rice are reduced/removed. Indian rice enters UAE markets at lower cost, gaining strong competitiveness.

• To Nigeria: With no FTA/PTA, exports face full tariffs, making Indian rice more expensive compared to suppliers with preferential access. Same exporter, same product, but two very different outcomes — because of trade agreements. ⸻ Types of Trade Agreements • PTA (Preferential Trade Agreement): Partial tariff reduction. Example: India–Afghanistan PTA

• FTA (Free Trade Agreement): Eliminates most tariffs. Example: India–UAE CEPA

• RTA (Regional Trade Agreement): Regional framework of FTAs/customs unions. Example: SAARC • MFN (Most Favored Nation): Equal treatment for WTO members. ⸻ Effect Categories in FTAs

• Open List: Fully liberalized (0% duty). • Negative List: No concessions at all.

• Sensitive List: Partial or delayed concessions. ⸻ Tariff Elimination Schedules

• E0: Zero duty from day one.

• E5: Zero duty phased out in 5 years. • E8: Zero duty phased out in 8 years. ⸻ - Rules of Origin (ROO) & QVC To benefit from an FTA, goods must meet origin criteria (e.g., minimum 35% value addition in India). QVC Formula: QVC = \frac{FOB - VNM}{FOB} \times 100 Where: • FOB = Free on Board price of the product • VNM = Value of Non-Originating Materials (imported inputs) - If QVC ≥ required threshold (say 35%), the product qualifies for FTA benefits. ⸻ -

Takeaway For exporters, understanding FTA rules + ROO compliance is not just paperwork — it directly affects competitiveness, pricing, and profit margins in global trade.