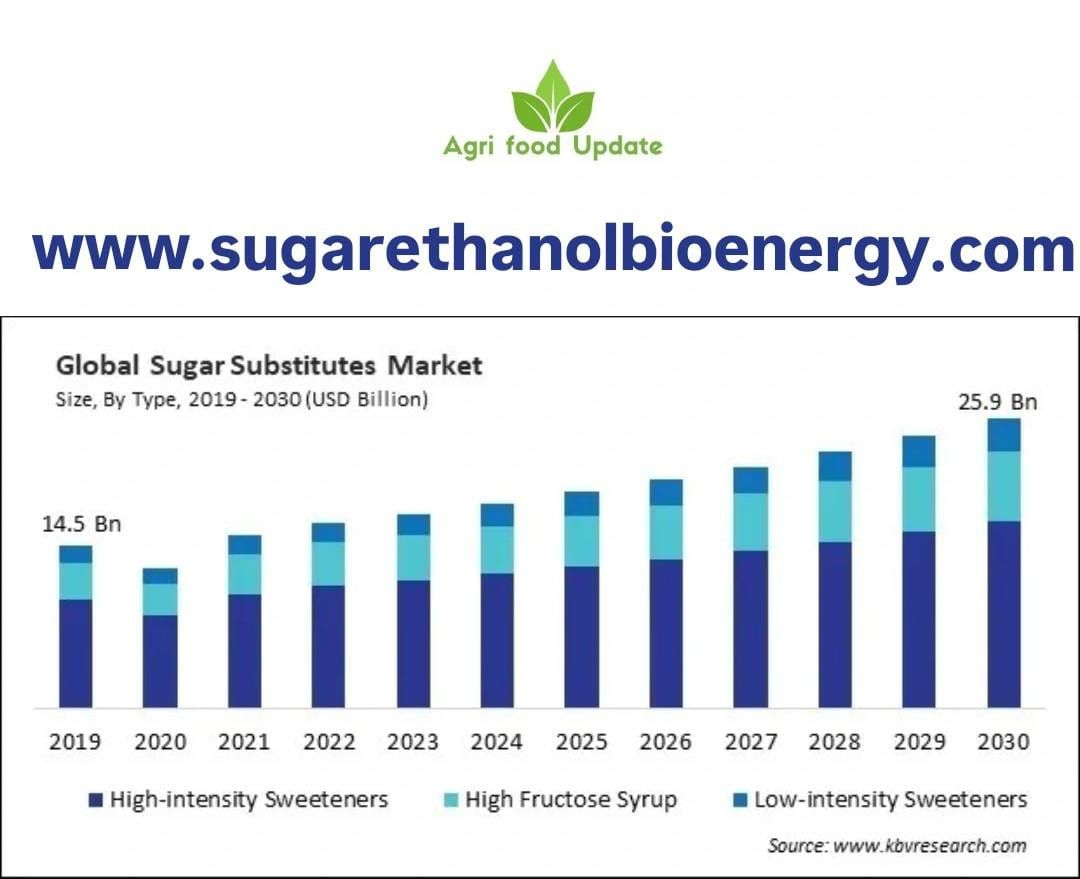

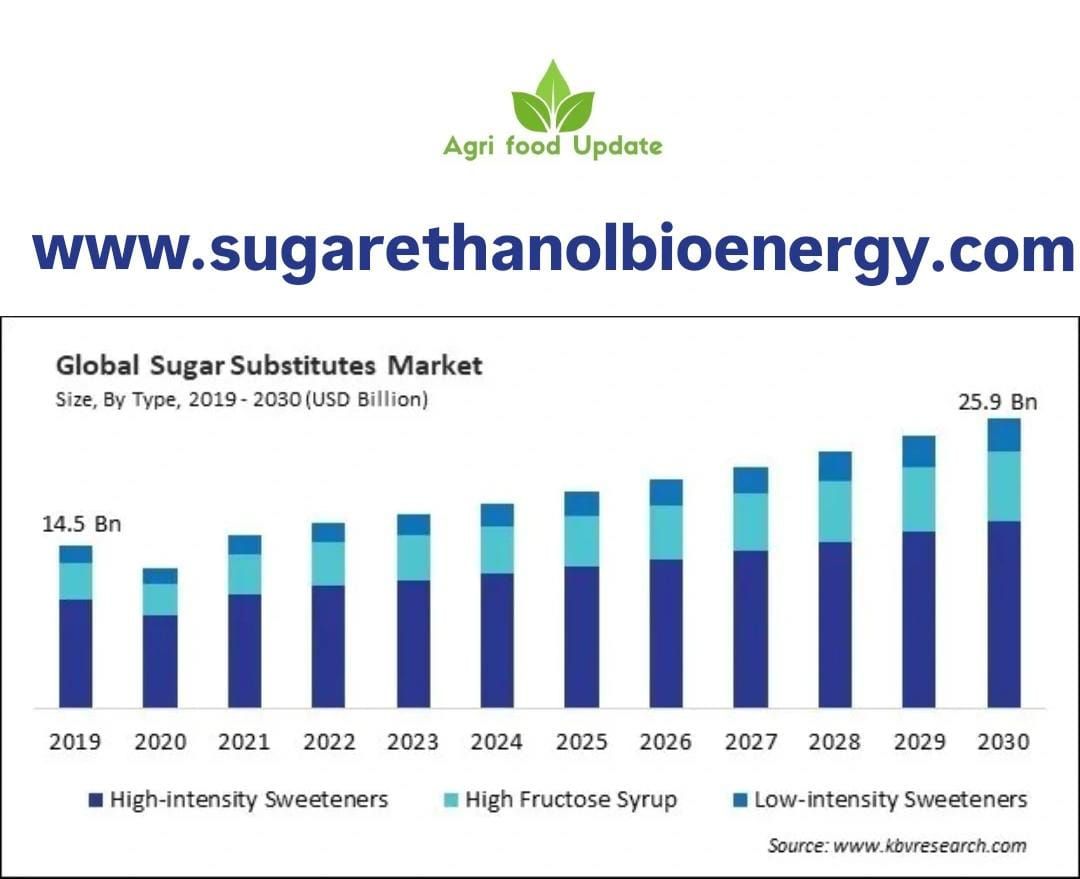

The global sugar substitutes market is witnessing a surge in demand, fueled by growing consumer health awareness, concerns around sugar intake, and lifestyle shifts toward low‑calorie diets. According to a recent Bonafide Research report, the market is expected to expand from USD 22.81 billion in 2024 to approximately USD 31.95 billion by 2030, registering a 5.90% CAGR over 2025–2030.

Rising Health Consciousness & Disease Prevention

With increasing rates of obesity, diabetes, and metabolic disorders, many consumers are rethinking sugar consumption. Sugar substitutes offer sweetness without the caloric burden, making them appealing for weight management and glycemic control.

Innovation in Natural & Clean Label Sweeteners

Natural sweeteners like stevia and monk fruit are gaining traction as “clean label” alternatives. Advances in extraction, blending, and formulation have helped reduce undesirable aftertastes and improved the performance of these substitutes in various food systems.

Broader Application Across Food & Beverage Sectors

Sugar alternatives are increasingly used in beverages, bakery & confectionery, dairy, dietary supplements, and even pharmaceuticals. Among these, beverages remain a dominant sector due to high volume and the strong push for “diet” or “zero‑sugar” variants.

Challenges & Risks

| Challenge | Explanation |

|---|---|

| Taste & Acceptability | Some substitutes have lingering aftertastes or different flavor profiles—overcoming this is critical for consumer adoption. |

| Cost & Scalability | Natural sweeteners and novel technologies can be expensive to produce. Scaling at competitive costs remains a hurdle. |

| Regulatory Hurdles | Some sweeteners face scrutiny or restrictions in specific markets (as “novel foods” or under food safety regimes). |

| Consumer Perception | Skepticism around artificial sweeteners and safety concerns can slow adoption, especially in health‑focused segments. |