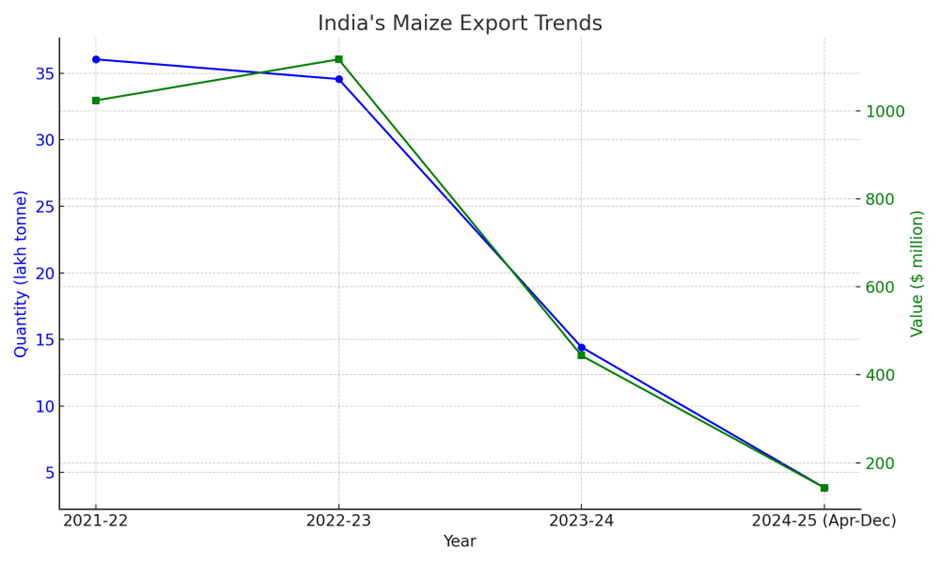

Higher Domestic Consumption Dampens Export Prospects

India’s maize (corn) exports have witnessed a sharp decline this year due to a significant increase in domestic demand from ethanol manufacturers and feed makers. The rising consumption, coupled with uncompetitive export prices, has restricted the country’s maize shipments.

Rahul Chauhan of IGrain India noted that while exports have occurred in limited quantities during November and December, the overall volume remains lower compared to last year. “Exports are taking place, but in limited quantities. During November and December, shipments were strong, but before that, the exports were weak. Overall, maize exports will be lower than last year,” said Chauhan.

Imports Surge as Domestic Shortfall Widens

On the flip side, India’s maize imports have increased to meet the rising demand, particularly from ethanol manufacturers. India maintains a strict policy prohibiting the import of genetically modified (GM) corn, with Ukraine and Myanmar being the primary suppliers of non-GMO maize. In 2024, India imported over 8.8 lakh tonnes of maize, with 4.37 lakh tonnes coming from Myanmar, 4.45 lakh tonnes from Ukraine, and 1,875 tonnes from Singapore.

Export Market Shrinks Due to High Domestic Prices

High domestic prices have rendered Indian maize uncompetitive in the global market, further curbing exports. Divya Kumar Gulati, Chairman of the Compound Livestock Feed Manufacturers Association (CLFMA) of India, highlighted the issue, stating that “exports to Nepal and South-East Asia have come to a halt as most of the maize is being consumed domestically.”

Additionally, the steep domestic prices have made Indian corn unviable for international markets. As a result, Nepal has resorted to allowing imports of GM corn to meet its needs. According to data from the Directorate General of Commercial Intelligence and Statistics (DGCIS), the value of maize exports to Nepal declined to $74.08 million this year (compared to $104.41 million last year), while shipments to Bangladesh dropped drastically to $13.86 million from $72.72 million. Similarly, exports to Malaysia plummeted to $0.74 million from $14.50 million. However, shipments to Bhutan increased to $12.84 million from $8.01 million, and exports to Sri Lanka rose to $21.64 million from $3.06 million.

Rising Demand from Feed and Ethanol Sectors

India’s maize demand for 2024-25 is estimated at 47.51 million tonnes, driven primarily by the poultry feed segment, which accounts for 22.25 million tonnes, followed by 5.47 million tonnes for cattle feed and 5.91 million tonnes for the starch sector. The fuel ethanol industry’s consumption is estimated to be 10.26 million tonnes, reflecting the rising importance of ethanol in India’s energy mix.

Production Estimates and Supply Shortfall

The industry estimates India’s maize production at 32.62 million tonnes, with exports expected to be around 2.7 lakh tonnes and imports at 1.2 million tonnes. Despite factoring in the supply of other grains at 2.75 million tonnes, India is expected to face a shortfall of over 11.6 million tonnes in 2024-25.

Agriculture Ministry’s Forecast for 2024-25

According to the Agriculture Ministry’s second advance estimate, India’s kharif 2024-25 maize production is pegged at 24.81 million tonnes, while the rabi 2025 output is estimated at 12.43 million tonnes, bringing the total maize output (kharif and rabi) to 37.25 million tonnes. Maize is also cultivated as a summer crop in select states, adding to the overall output.

Balancing Demand and Supply

With rising domestic demand and a supply shortfall on the horizon, India’s maize market is expected to remain tight in the coming months. High prices, coupled with increasing ethanol and feed consumption, could continue to restrict exports, while imports might play a more prominent role in meeting the shortfall. The government may need to strike a balance between ensuring domestic food security and maintaining competitiveness in the global maize trade.

Follow & Subscribe:

👉 Agri-Food Update on LinkedIn for the latest updates and insights.

🌐 Visit us at www.agri-food-update.com for more information!