KUALA LUMPUR/JAKARTA, April 28, 2025 —

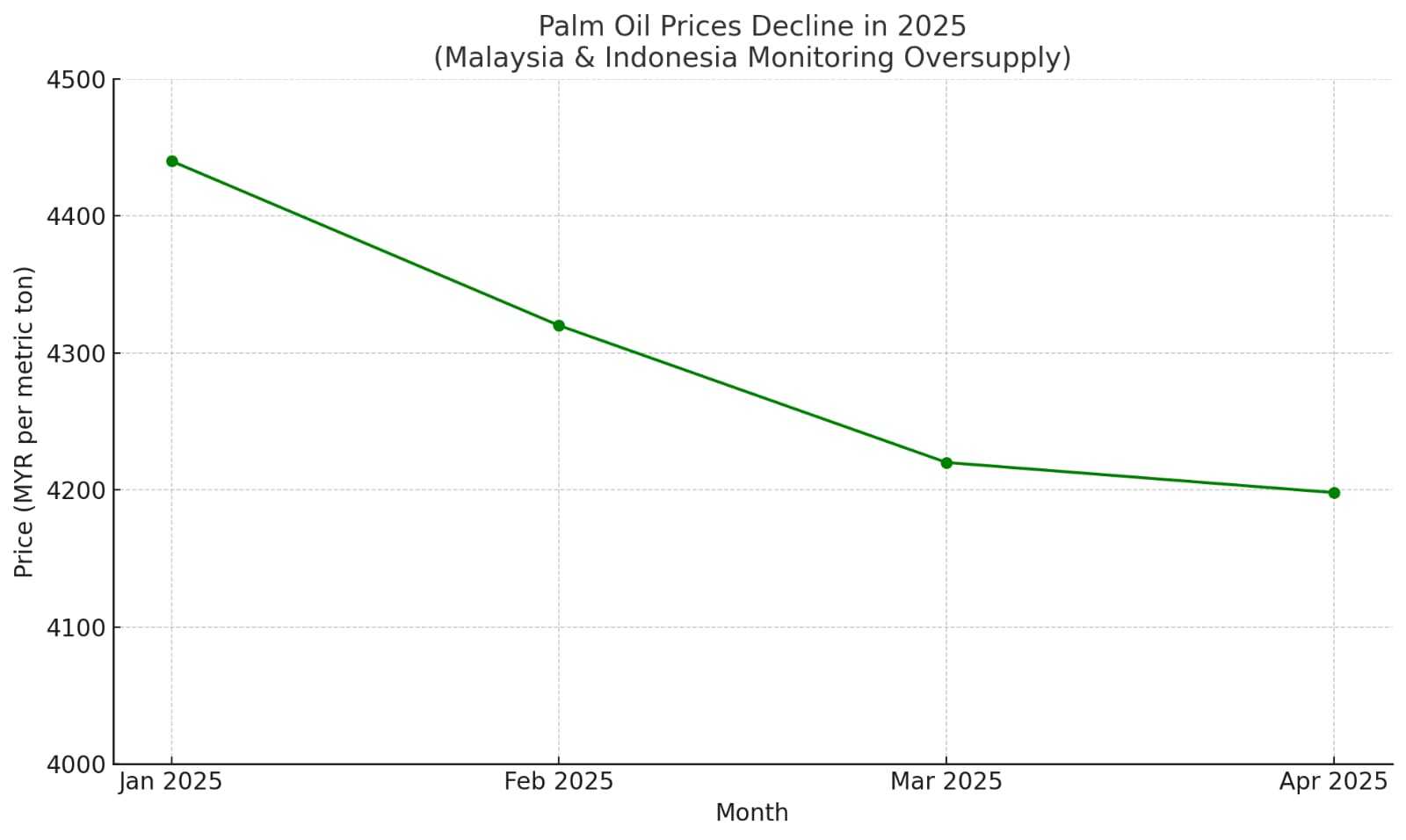

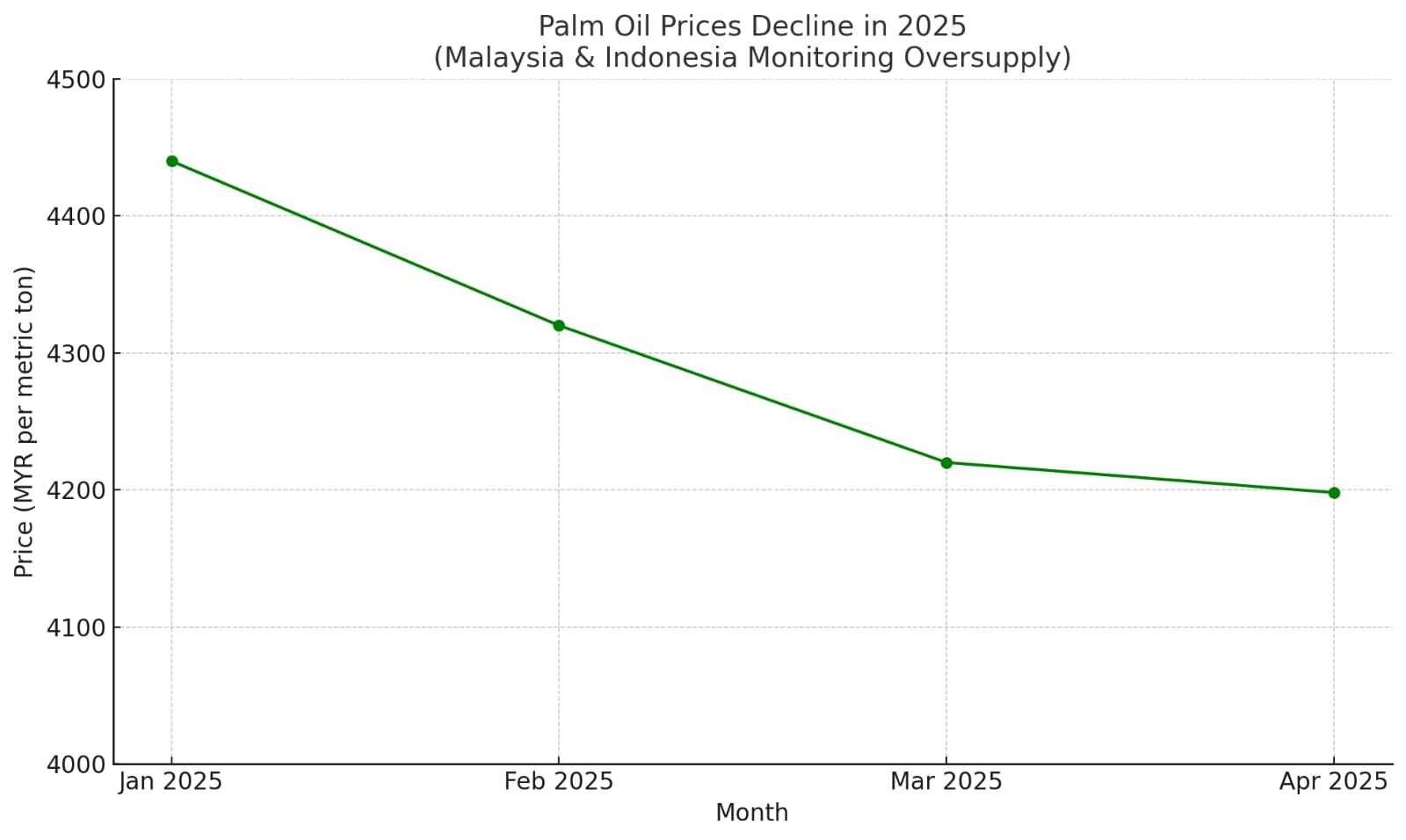

Palm oil prices have fallen sharply in early 2025, declining approximately 5.5% since January, with benchmark futures currently trading around 4,198 Malaysian Ringgit (MYR) per metric ton. The drop is largely driven by concerns over global oversupply and weaker-than-expected demand from major importing countries such as India, China, and the European Union.

Industry analysts point to a combination of factors behind the price weakness. Favorable weather conditions across Southeast Asia have boosted yields, leading to higher production volumes in the first quarter. In addition, high carryover stocks from late 2024 have further contributed to a supply glut, putting downward pressure on prices.

Indonesia and Malaysia, the world's top two palm oil producers accounting for nearly 85% of global output, are closely monitoring the situation. Authorities in both countries are reportedly considering measures to stabilize the market, including potentially expanding biodiesel programs and implementing export restrictions to manage stock levels.

"Inventories are growing faster than demand can absorb," said Ahmad Rasyid, a commodities analyst based in Jakarta. "Unless we see stronger buying from key markets, or significant government intervention, prices could remain under pressure through mid-year."

Import demand has also been affected by economic uncertainty and shifting dietary preferences in some regions. In India, the largest palm oil importer, buyers are cautious amid high domestic oilseed production, while in Europe, regulatory pressures tied to sustainability concerns continue to weigh on demand for palm-based products.

Meanwhile, crude oil prices — which often influence palm oil through its use in biodiesel production — have remained relatively stable, limiting the upside support for palm oil prices.

To counter these challenges, Malaysia's Palm Oil Board (MPOB) and Indonesia's Council of Palm Oil Producing Countries (CPOPC) are reportedly stepping up diplomatic efforts to promote palm oil exports, especially to newer markets in Africa and Central Asia.

Despite the short-term weakness, market players remain cautiously optimistic about a potential price recovery later this year, provided that stock levels moderate and global economic conditions improve.

"The fundamentals of palm oil as a versatile and affordable vegetable oil remain strong," said Nurul Azhar, an executive at a Malaysian palm oil exporter. "But in the immediate term, the sector must navigate the headwinds of oversupply and market uncertainty."

Palm oil futures will continue to be closely watched over the coming weeks as the peak production season approaches and demand prospects for the second half of 2025 become clearer.

Follow & Subscribe:

👉 Agri-Food Update on LinkedIn for the latest updates and insights.

🌐 Visit us at www.agri-food-update.com for more information!