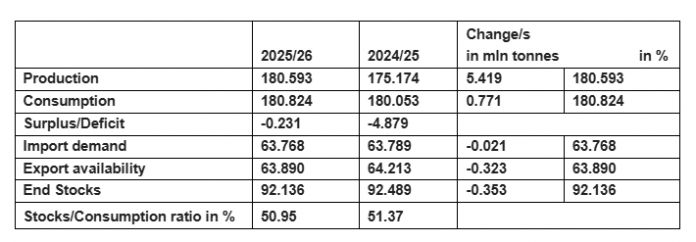

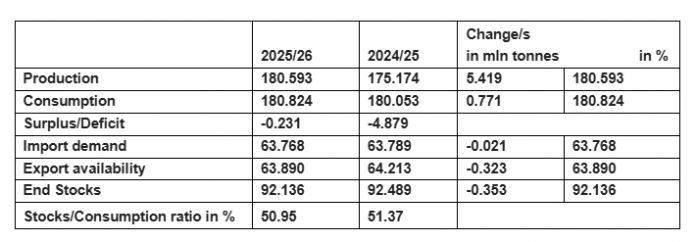

Season 2025-26: ISO sees global sugar deficit of just 0.231 million tonnes - Friday, 29 August 2025 ISO’s fundamental view of the global supply/demand situation sees a global deficit (the difference between forecast world consumption and production) of just 0.231 million tonnes. A global deficit of this magnitude, ahead of the start of the season, can be considered as negligible, although the narrowing of the deficit compared to 2024/25’s revised figure of 4.879 mln tonnes is significant.

World production in 2025/26 was estimated at 180.593 mln tonnes, up 5.419 mln tonnes from last season, with increased production in India, Thailand and Pakistan. World consumption is projected to reach 180.824 mln tonnes in 2025/26, up 0.771 mln tonnes on last season, while the 2023/24 estimate is revised to 181.639 mln tonnes, up from 179.225 mln tonnes previously, on submissions from ISO members. These revisions show consumption in 2023/24 set an all-time high.

According to the ISO, changes in trade dynamics are key market considerations. The estimated volume of trade in 2025/26 is anticipated to remain steady with exports totalling 63.890 mln tonnes, up from 63.323 mln tonnes last season, but far below the 2023/24 total of 69.342 mln tonnes. The trade flow outlook for 2025/26 is neutral as import demand is estimated at 63.768 mln tonnes.

Trade statistics for 2024/25 show a surplus of 0.656 mln tonnes, with exports reaching 64.213 mln tonnes. The sequence of global deficits now stretches back to the 2019/20 season, with stock having to be found and liquidated each season in order to alleviate the shortfall in production. This process has brought the projected season-ending stock total for 2025/26 to 92.489 mln tonnes, down more than 10 mln tonnes from the opening stock total in 2019/20. The ending stocks/consumption ratio for 2025/26 is estimated to fall to 50.95%, some 10% below the figure from 6 seasons ago. As has been the norm over the last year, the ISO has also been reporting an adjusted stock total figure, to reflect losses in the refining process as well as stock updates from members. This is detailed in the first brief of the World Sugar Market section. As per the ISO release, speculators have maintained a significant net-short position since June, when they doubled their directional participation to over 100,000 lots or 5 mln tonnes of sugar. This high level of activity continued through July, peaking in early August when a net-short position of 151,004 lots, or roughly 7.7 mln tonnes of sugar, was reached.

Commodity basket indices have broadly maintained their net-long over the latest three months, although it remains at the low levels initially attained in May, as US tariff uncertainty and geopolitical risk in other parts of the world continues.